Providing Flexible Living in Stable Communities for our Tenants And Strong Financial Performance for our Investors

Long before the pandemic, in many cities across the country it had become increasingly difficult for middle-income workers to find reasonable rentals in the areas where they worked due–in large part–to both wages not keeping up with increasing costs of living, and a limited supply of affordable housing.

In response, cities like Chicago started expanding outward… and so did the work force.

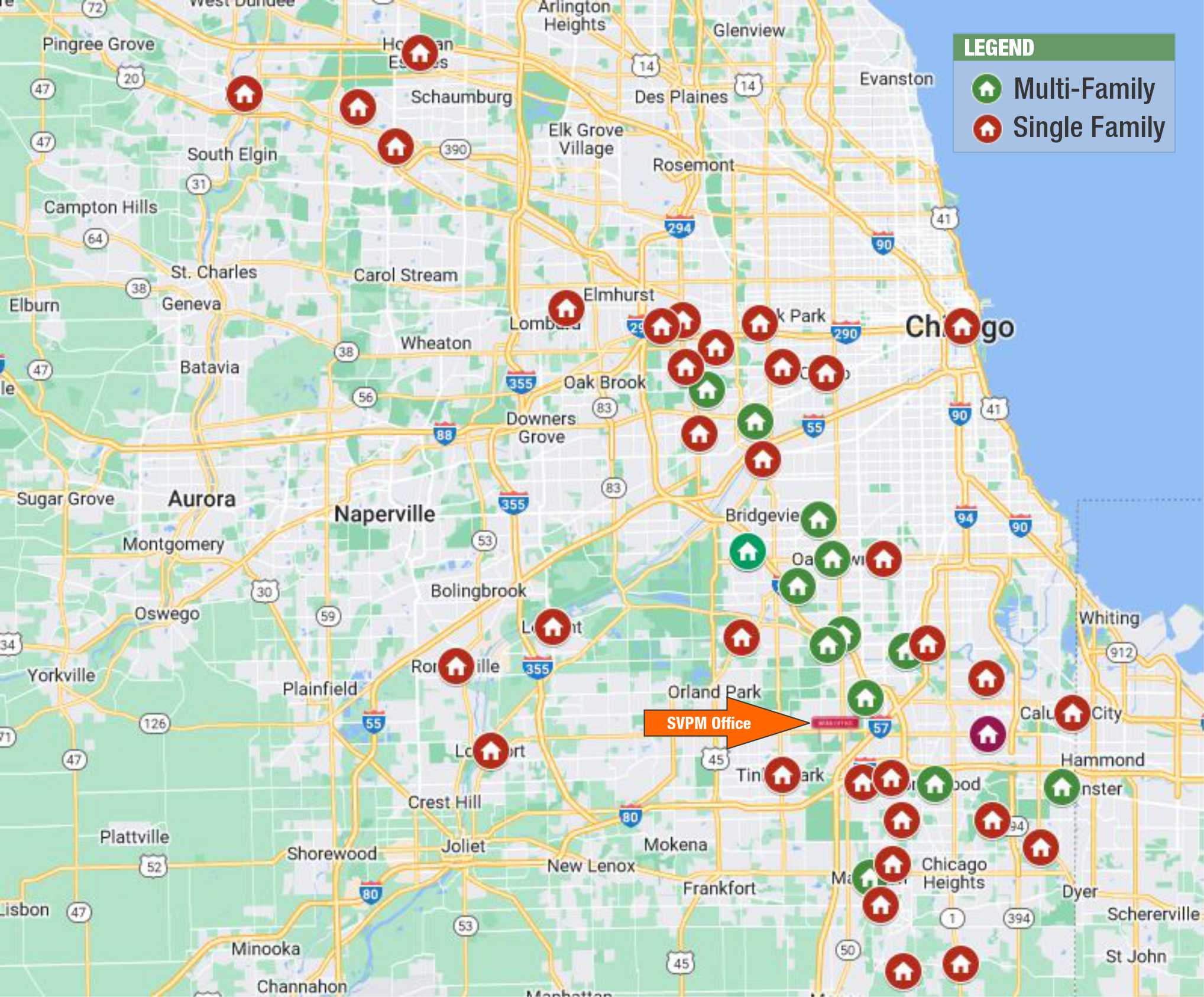

Today, Chicago and its suburbs make up the third largest metropolitan area in the U.S., which is commonly referred to as Chicagoland. Recognizing this market’s incredible investment potential, in 2012, Harold Willing established SpringView with the objective of creating a stable income stream in a risk-mitigated environment.

Since then, Chicagoland has afforded SpringView the opportunity to purchase assets that had favorable rents versus their purchase prices for below replacement cost, thereby allowing for an improved quality of life for tenants.

SpringView communities have rich histories and are demographically and ethnically diverse. All are in close proximity to key employment centers, transportation, school districts, shopping, restaurants, recreation, have abundant green space, and are conveniently located to downtown Chicago.

Aggregating non-institutional assets to create institutional opportunities for its investors, SpringView’s focus on working class neighborhoods and long-term investment outlook, supported by local lending relationships, brokers and property management, allows us to execute on transactions, even in an uncertain interest rate environment.